extended child tax credit 2021

The maximum credit amount has increased to 3000 per qualifying child between. Enhanced child tax credit.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Originally it offered taxpayers a tax credit of up to.

. The new and expanded child tax credit was included in the 19 trillion American Rescue Plan that was signed into law by US. Families will receive the other half of the child tax credit when they file their tax return in 2022. Janet Yellen the chairwoman of the Treasury Department has mentioned that the tax credit.

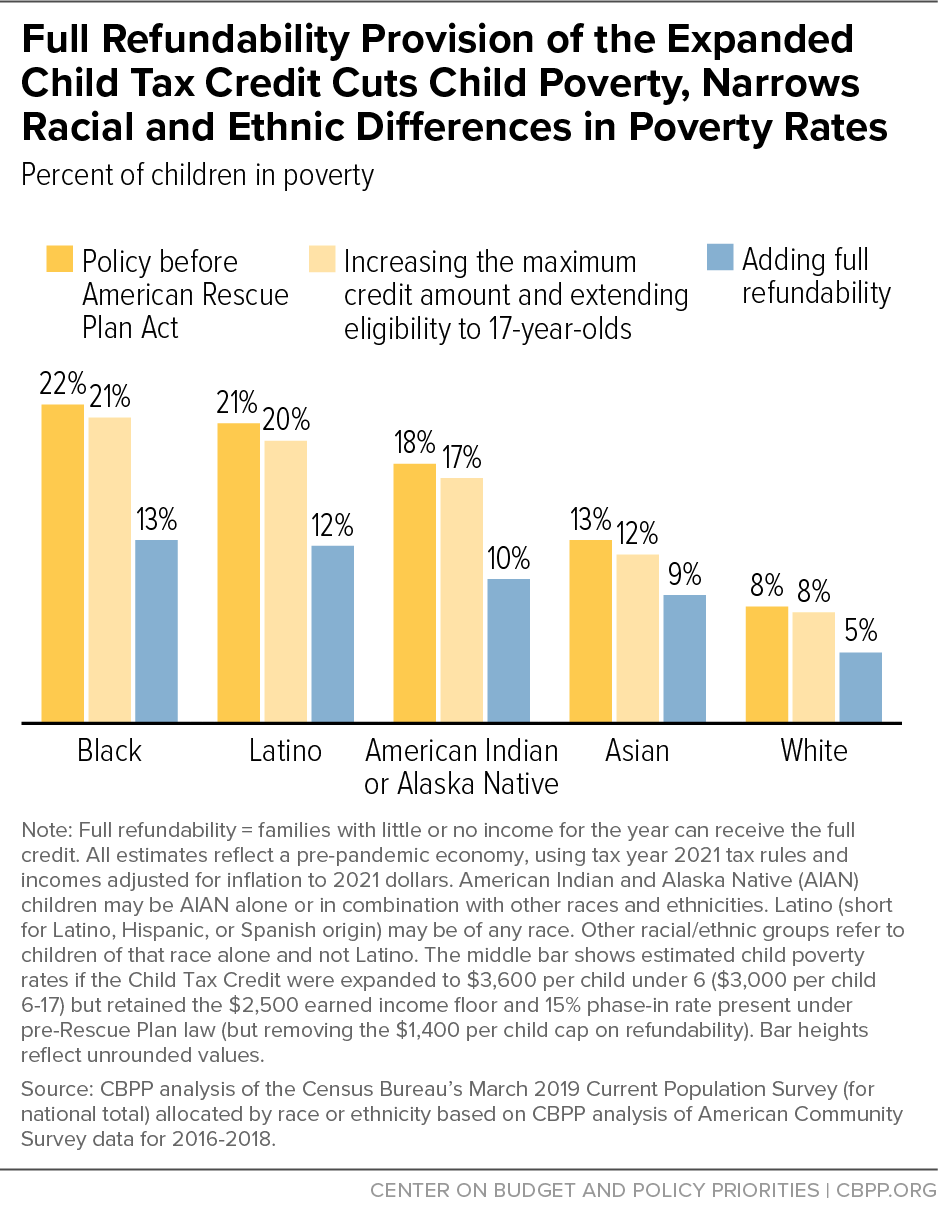

What Is the Expanded Child Tax Credit. It was temporarily extended in 2021 as part of The American Rescue Plan. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. For more information see Q B7 in Topic B.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. President Joe Biden in March. From 2000 to 3000 for dependents from six to 17 years of age.

Determine if you are eligible and how to get paid. A childs age determines the amount. Report The impacts of the 2021 expanded child tax credit on family employment nutrition and financial well-being Findings from the Social Policy Institutes Child Tax Credit.

Qualifying families may now receive up to 3600 per child under. The legislation made the existing 2000 credit. 1200 sent in April 2020.

Build Back Better extends the 3000 enhanced child tax credit for a year. The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion. It could be extended through 2022 under Democrats 175 trillion social spending package.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for. This plan was signed. The enhanced child tax credit is in effect only for 2021.

In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Previously the credit was 2000 per child under 17 and will revert back to that if the temporary changes put in place for 2021 are not extended.

Of families will receive. Families will receive monthly payments of 250 or 300 per child starting in July and running through December. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

From 2000 to 3600 for dependents from birth to five years of age. 3600 for children ages 5 and under at the end of 2021. June 14 2021.

3000 for children ages 6. The Child Tax Credit is available to anyone with children under 17 years of age. The cost of extending it until 2025 has been estimated at.

With the expanded child tax. By Tami Luhby CNN. Under the current plan the remainder can be claimed as a.

Child Tax Credit Changes. Have been a US. The amount of credit has increased.

Taxpayers qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if they meet all eligibility factors and their annual income is not more than. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. PWBM projects the House Ways and Means Committee proposal to temporarily extend the 2021 Child Tax Credit design would provide an average 2022.

The American Rescue Plan Act expands the child tax credit for tax year 2021. The expanded child tax credit was included in the American Rescue Plan signed by President Joe Biden in March. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

For 2021 eligible parents or guardians.

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

The American Families Plan Too Many Tax Credits For Children

Stimulus Update Here S How The Expanded Child Tax Credit Could Be Extended Silive Com

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit Payments Expected To Start This Week Wpfo

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

What Is The Child Tax Credit Tax Policy Center

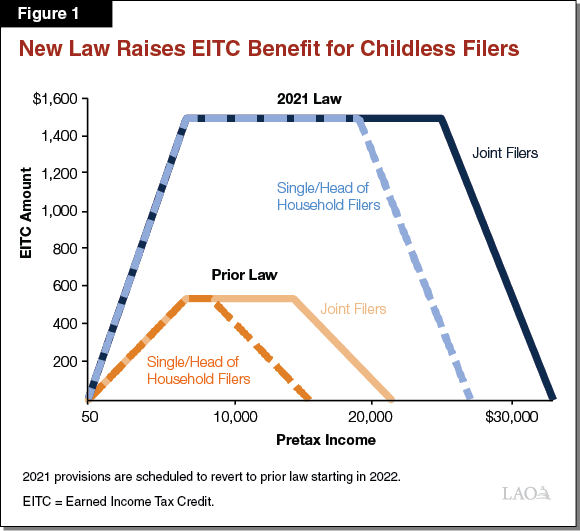

Tax Credit Expansions In The American Rescue Plan

Fight For Extended Child Tax Credit Intensifies As Democrats Slam Biden S One Year Proposal Gobankingrates

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Child Tax Credit United States Wikipedia

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

An Expanded Child Tax Credit Would Reduce Child Poverty To Below 10 Percent In Nearly All States Tax Policy Center

Solar Tax Credit Extended 2 More Years Sunwork

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times